COVID-19 stimulus checks didn’t ease low-income Latino families’ stress

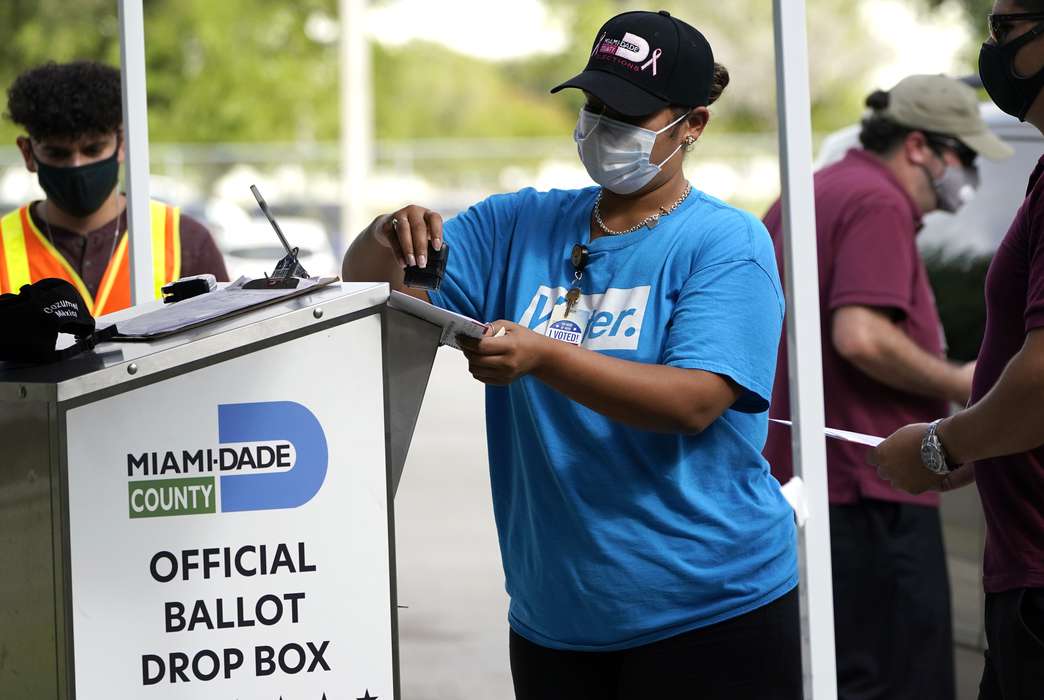

Last April's stimulus didn't alleviate economic stress among Latino families. (Unsplash/Omar Lopez)

The one-time, $1,200 stimulus checks the U.S. government distributed last April in an attempt to offset the economic burden of the rapidly spreading pandemic did not alleviate stress, anxiety or depressive symptoms related to the coronavirus, particularly among low-income Latina mothers and their families, new research shows.

The Latino community has been especially vulnerable to the economic and health risks of the pandemic as a consequence of systemic oppression, according to Leah Hibel, an associate professor at the University of California, Davis, and the lead author of a paper published in this month’s edition of the Traumatology journal.

“Systemic institutional discrimination and the exponential increase in internal immigration enforcement have perpetuated a greater likelihood of experiencing poverty and low-wage work among Latino families,” Hibel and her co-authors said in the paper. “Systemic oppression of Latina women’s multiple and intersecting identities contributes to gendered differences in response to the COVID-19 pandemic.”

Between March and June 2020, the researchers surveyed 70 low-income Latino families with children living in California. In roughly 30% of the families there was no employed adult. Of the employed parents, 91.7% were classified as essential workers. Hibel found that due to the pandemic, 52.7% of the mothers reported being forced to engage in economic cutbacks.

Hibel measured cutbacks such as individuals falling behind on car payments, turning off the air conditioning, buying less food, buying less clothes and selling possessions even though they wanted to keep the items. These cutback actions were associated with greater reports of depressive and anxiety symptoms. And the participant mothers experienced stress during the COVID-19 lockdown stemming from worries about contracting the virus themselves and having to make further budget reductions.

The researchers determined that receiving the $1,200 stimulus payment did not reduce cutbacks among the families, nor did it lessen their worries, stress or depressive and anxiety symptoms, especially among mothers.

About half of the sample reported buying less food, falling behind on bills and missing rent payments. And though the stimulus may have prevented some families from falling below the poverty line in the short term, the study suggests that many low-income families are still facing significant financial hardship.

Hibel told The Academic Times that the fact that the first stimulus check had no immediate, positive impact on these families speaks to how much they were already struggling before the pandemic. City shutdowns, shelter-in-place orders and job layoffs pushed many individuals further into poverty, and the stimulus check was “nowhere near sufficient” to cover their past economic hardships and those caused by COVID-19, she said.

“How the pandemic was experienced is vastly different based on who you are. This crisis hugely aggravated and compounded the institutional racism that we see in this country,” Hibel said.

The families in the current study started the pandemic with no savings cushion they could tap into and were already living paycheck to paycheck before COVID-19. Nationally, the Latino population was hit particularly hard by pandemic-related layoffs. Among the sample, the unemployment rate was close to 30%.

Hibel, who has a background in studying how stress impacts families, said that policymakers need to understand that one-off stimulus payments aren’t enough to make up for one month of hardship when families have now struggled through nearly 11 months of pandemic stress.

The government did not approve or distribute further stimulus payments until late December, Hibel noted, and at the time of the first checks in April, Americans were unsure whether the payments would continue, which caused additional stress.

“If you lose your job for a month, but then you get a job the next month, you’re still a month behind. If you lose your job for two months, and then you get a job, you’re two months behind,” Hibel explained.

“For a family that had substantial reserves, during a month of unemployment they might be able to dip down into their savings. But for families that are in poverty, there’s nothing to dip into, and so that debt is just kicked down the road to when they do have a job. And [then] they’re expected to pay three months of rent,” she continued.

Hibel noted that previous research has found that being in poverty or falling into poverty can cause depression, and that economic downturns, financial cutbacks and being low-income can all cause stress. She emphasized that there is no greater stressor than what the world is currently dealing with in COVID-19, and addressing the psychological impact of the pandemic should go hand-in-hand with the economic impact.

“Even if the physical health crisis is no longer present, the mental health crisis will persist, especially if we do not appropriately attend to the economic crisis,” Hibel said.

The study “The Psychological and Economic Toll of the COVID-19 Pandemic on Latina Mothers in Primarily Low-Income Essential Worker Families” was published in the January edition of the Traumatology journal. Leah Hibel, of the University of California, Davis, served as the lead author. Chase J. Boyer, Andrea C. Buhler-Wassmann and Blake J. Shaw, all of the University of California, Davis, served as co-authors.

This story has been updated to include additional information about the families surveyed in the study and to correct the unemployment rate.